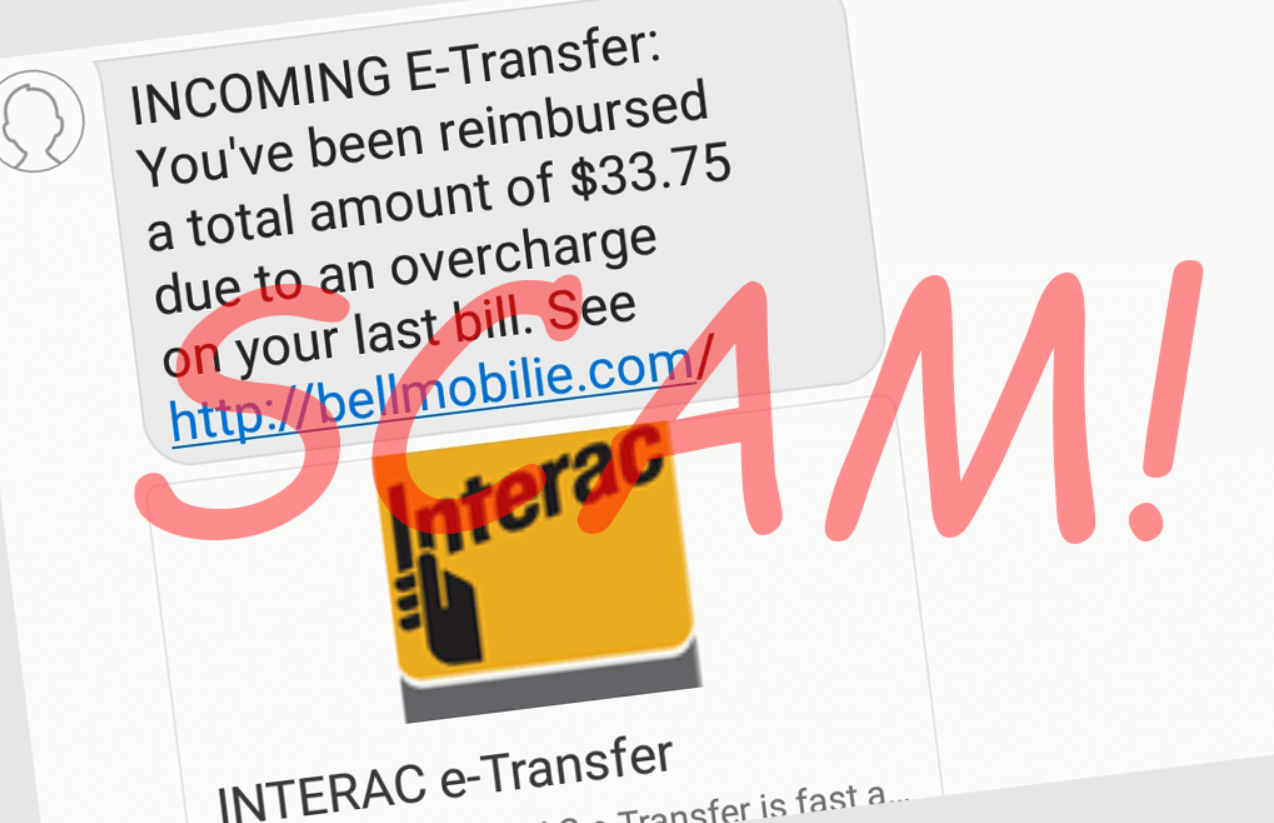

At our company, we take security very seriously. We understand the importance of keeping your personal information safe and secure, which is why we’ve put together this article to help you avoid falling victim to the latest e-Transfer scam that’s making the rounds. Our goal is to provide you with the information you need to stay one step ahead of the scammers and protect your hard-earned money.

What is the e-Transfer scam?

The e-Transfer scam is a type of fraud that involves criminals tricking you into sending money through an Interac e-Transfer. They typically pose as someone you know or a legitimate business and use a sense of urgency to convince you to send them money quickly. The scammer will often claim that there’s an emergency or a pressing need for the funds and that you’ll be rewarded for your help. Unfortunately, once you send the money, it’s gone for good.

What are auto-deposits and why were they cancelled?

Autodeposit is a feature of Interac e-Transfer that allows funds to be automatically deposited into a recipient’s bank account without requiring them to answer a security question. This feature can be convenient for regular transactions, but it also poses a security risk.

Recently, Interac cancelled auto deposit for all e-Transfer transactions as a precautionary measure to help prevent fraud. The cancellation was made because scammers had found a way to bypass the security measures put in place to protect users’ information. By cancelling auto deposit, Interac is ensuring that all transactions are subject to the usual security protocols, which include requiring the recipient to answer a security question before the funds can be deposited.

How to protect yourself from the e-Transfer scam

Here are some tips to help you protect yourself from falling victim to the e-Transfer scam:

- Be wary of unexpected e-Transfers. If you receive an e-Transfer from someone you don’t know or weren’t expecting, be cautious. It’s always a good idea to verify with the sender before accepting the transfer.

- Verify the recipient’s email or phone number. Before sending an e-Transfer, make sure that the recipient’s email or phone number is correct. Scammers will often use similar email addresses or phone numbers to trick you into sending money to the wrong person.

- Never share your security question answer. The security question answer is there to protect your money, so never share it with anyone, even if they claim to be from your bank.

- Use strong passwords and two-factor authentication. Protect your online banking login with a strong password and enable two-factor authentication to add an extra layer of security.

- Report suspicious activity. If you suspect that you’ve been a victim of the e-Transfer scam or have received a suspicious e-Transfer, report it to your bank immediately.

Conclusion:

In conclusion, the e-Transfer scam is a serious threat that can result in significant financial losses. By following the tips outlined in this article, you can help protect yourself from falling victim to this type of fraud. Remember to always be cautious when receiving unexpected e-Transfers, verify the recipient’s information, never share your security question answer, use strong passwords and two-factor authentication, and report any suspicious activity to your bank right away. Stay safe and secure!

What about the insane flaw in the e transfer system that allows you to change the password on the transfer when you receive it? This scam has been around for about a decade and all the banks and Interac are well aware of it.

Send someone a transfer with it password protected. Send them a second transfer. The password for the second transfer will also work on the first one.

With a few of the banks you’ll even see the security question for the first transfer re-write itself to match the second.

Call the bank after you’re scammed and they’ll tell you you must have used the same one twice.

I spent an hour on the phone with with one banks fraud prevention specialist who admitted the flaw but said they were not allowed to reimburse victims or even admit it existed.